On Being Debt-Free: How I Stopped Buying Stuff I Couldn't Afford

1:39 PM

I've talked about money before. Though it's been a while, you're no stranger to real-life talk around here. This year I'd like to share more life, in addition to parties and home decor. The first topic on the docket: the first step to becoming debt free.

I should clarify that we are not truly debt free- we have a mortgage. However, we have zero consumer debt, school loan debt, car note debt, etc. And it feels good. We had 50K in school loans (YIKES) and paid mine off after taking Dave Ramsey's Financial Peace. But we slowed down when I quit my job (and then had a 2nd baby and then had a 3rd and then sent the first two babies to private school...). But now we're on track and I'm sharing my struggles (they're real) and some tips if you're on a similar journey. The first step to becoming debt-free was to stop overspending. Duh right?! I'm going to be vulnerable here so let's just declare this a judgment-free zone mkay?

EDITED: This post was almost complete a week ago. But I kept writing and re-writing because I want to be honest, encouraging, and informative but not come across as preachy. It's also kind of embarrassing to share my struggles. I've been working on contentment for years! (exhibit 1!) While I've made strides, I'm still working on it, always. Contentment and gratitude. Because at the end of the day, without either, it's almost impossible to avoid excess and live within one's means. Ok, imperfect post or not, here goes...

Why is it that I don't compare 'down.' just 'up?' It's extremely easy to look at what others are doing and buying (especially with social media use) and get a twisted perspective of reality. At the same time, there are people who are struggling and I prefer not to think about that. The truth is, we never know the full story. People might be in debt. They might not have a retirement account. They might have parents/grandparents who help them (or helped them) financially. They may be financially savvy. They might just be the 1%. ha. My point is, besides the fact that comparison is the thief to everything, we're not even comparing apples to apples. Two people could earn the exact same income and have very different lifestyles due to a variety of factors.

Tip: Stay in Your Lane

Even though I tell myself the stories above if I'm feeling insecure about our lifestyle, the truth is the goal is to stop taking my cue from others. It's really none of my business. If you're going to compare, try comparing your present to your past. Sure our home could be perfectly decorated but when I look at our last home, we've come a long way baby. Surround yourself with people who have similar goals as you- I love Joe's brother and our sister-in-law for this reason (among many). They are always encouraging us in the Dave Ramsey lifestyle. We feel "normal" around them. My favorite encouragement here is this: "Pay careful attention to your own work, for then you will get the satisfaction from a job well done, and you won't need to compare yourself to anyone else." Galatians 6:4

|

| Photo by rawpixel on Unsplash |

This is not my strong suit. And quite frankly staying home for all these years has lessened my discipline to some extent (more on that in a future real-life post?). Joe often repeats Dave Ramsey's mantra: "Children do what feels good. Adults make a plan and stick to it." Man, this is such a good rule for LIFE. Having to have it now puts us on the outs of the debt-free journey. As I get older, I get slightly better in this regard. Mostly because I look around at "things" I had to have a year ago that just don't matter much today. [Looks at a pile of clothes from Old Navy. ha].

Tip: Sleep it over

Not to be a broken record (or sound like an old person), but the tiny computer in our hand makes it easy to be compulsive. As soon as I think of something, I can order it. I can then have it at my front door within 2 days. And say I google it but then practice restraint (gasp). We all know what happens- it stalks us. It's on the sidebar of our email, it's in our Facebook feed, it's a sponsored post on Instagram. In a weak moment, I'm back at square one. When I'm feeling tempted to spend unwisely, I tell myself, 'you can order it tomorrow.' By the time tomorrow comes, the frenzy in my mind has died down. If I'm at a store, I'll even ask them to hold the item. If I really want it, I'll drive the 15 minutes back to the store and get it. If it's not worth driving back for, did I really want it that badly to begin with? My favorite encouragement here is this: "For God has not given us a spirit of fear but one of love, power, and self-control." 2 Timothy 1:7

|

| Photo by Artem Bali on Unsplash |

I am a bargain shopper. Admitting you have a problem is the first step to overcoming right?! Often this is a good thing but sometimes it's a waste. I for sure have justified purchases simply because "it was a good deal." I once saw a meme on black Friday that said: "I saved 100% by staying home today." I should probably frame it.

Tip: Think it over

I'll often ask myself if I'd even consider the item at full price. Is this an item you'd even thought about before seeing its price tag? Do you have a place for it? Do you need it? The other day I bought pillows for the girls' room (shared them in my stories!) that I've loved ever since they were $90 (ouch). When I stumbled upon them for less than1/3 of that, I knew it wasn't simply because of the price. When I purge, I notice that the items rarely used or worn were some of the best "deals." My favorite encouragement here is this: "The Lord is my shepherd. I have everything I need." Psalms 23:1. If you're like me, you might need to repeat this one ad nauseam. ;)

This is getting into tricky territory ya'll. When I'm sad, anxious, overwhelmed- whatever- it can be so tempting to "reward" myself. I deserve this! I work hard all day. I'm tired of "making good choices." But you know what? Children do what feels good. Adults make a plan and stick to it. "I deserve it" is what marketers tell us to get us to buy stuff! It's not a reason to make a purchase.

Tip: Self Care.

I'll be honest- this tip is more in theory than real life. It's what I wish I did. Instead of buying something when you're feeling down, take a bubble bath, do your nails, watch a chick flick, read a juicy novel. Do something out of the ordinary that makes you feel good but doesn't cost a dime. My favorite encouragement here is this: "So let's not get tired of doing what is good. At just the right time we will reap a harvest of blessing if we don't give up." Galatians 6:9

Avoidance doesn't work when it comes to finances. While it sometimes stresses me out to sit down and "look at the books," it's a must. When I don't, I assume we have "enough," but when I'm spending it, there's a tiny bit of anxiety that comes with every purchase.

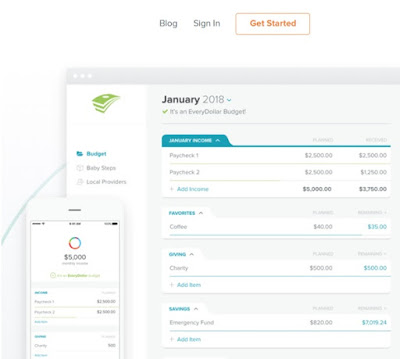

Tip: YNAB or Every Dollar

Talk through your finances with your partner or a trusted advisor and use a budgeting app. We used to use cash which works really well until a trip to Target requires piling 3 kids into a minivan and "training" them to behave in the checkout lane. It's a no from me dawg. I'd still use cash if I could because similar to leggings, it NEVER lies. Instead, we use Every Dollar which works much better with online shopping. We set the budget each month (sometimes we can just copy and paste) and stick to it. It's surprisingly freeing. Some encouragement for budgeting: "Good planning and hard work lead to prosperity, but hasty shortcuts lead to poverty." Proverbs 21:5

Summary

There are challenges I didn't cover, like contentment (wanting less is sort of my goal) or having expensive taste and liking everything to be pretty (#CantHelpIt). I might pop back in with a few others + tips for frugal living and staying motivated. But getting spending under control was a major part of becoming consumer debt-free so I wanted to start there. While we certainly don't do everything right (definitely bought our first house way too soon!), we've learned a lot along the way and at this point, we're working on increasing our savings. Next, we'll start to get serious about paying off our mortgage early. If you're longing to be free from debt, know that there are others right there with you. You might not always be able to tell, but rest assured that you're not alone. My final encouragement is this: "Yet godliness with contentment is itself great wealth." 1 Timothy 6:6

Tip: YNAB or Every Dollar

Talk through your finances with your partner or a trusted advisor and use a budgeting app. We used to use cash which works really well until a trip to Target requires piling 3 kids into a minivan and "training" them to behave in the checkout lane. It's a no from me dawg. I'd still use cash if I could because similar to leggings, it NEVER lies. Instead, we use Every Dollar which works much better with online shopping. We set the budget each month (sometimes we can just copy and paste) and stick to it. It's surprisingly freeing. Some encouragement for budgeting: "Good planning and hard work lead to prosperity, but hasty shortcuts lead to poverty." Proverbs 21:5

Summary

There are challenges I didn't cover, like contentment (wanting less is sort of my goal) or having expensive taste and liking everything to be pretty (#CantHelpIt). I might pop back in with a few others + tips for frugal living and staying motivated. But getting spending under control was a major part of becoming consumer debt-free so I wanted to start there. While we certainly don't do everything right (definitely bought our first house way too soon!), we've learned a lot along the way and at this point, we're working on increasing our savings. Next, we'll start to get serious about paying off our mortgage early. If you're longing to be free from debt, know that there are others right there with you. You might not always be able to tell, but rest assured that you're not alone. My final encouragement is this: "Yet godliness with contentment is itself great wealth." 1 Timothy 6:6

What tips do you have for leaving within your means?

0 comments